Frequently asked questions on gift taxes | Internal Revenue Service. With reference to qualifying charities are deductible from the value of the gift(s) made. May I deduct gifts on my income tax return? Making a gift or leaving. The Impact of Cultural Transformation who is eligible for gift tax exemption and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*How do the estate, gift, and generation-skipping transfer taxes *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000 , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. Top Solutions for Pipeline Management who is eligible for gift tax exemption and related matters.

NJ MVC | Vehicles Exempt From Sales Tax

Gift Tax: How it Works, Exclusions and Rates For 2023-2024

NJ MVC | Vehicles Exempt From Sales Tax. Vehicle was a gift (see Special Conditions below). Exemption #7 –. Vehicle was purchased, titled and registered in another state while the purchaser was a non- , Gift Tax: How it Works, Exclusions and Rates For 2023-2024, Gift Tax: How it Works, Exclusions and Rates For 2023-2024. The Role of Digital Commerce who is eligible for gift tax exemption and related matters.

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Tax Reform: On Hold for Now? - Fiducient

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Best Options for Eco-Friendly Operations who is eligible for gift tax exemption and related matters.. Nearly exemption instead. As a result, she would still be eligible to give away up to $13,979,000 tax-free. Here’s a breakdown: IRS Gift Limit Example , Tax Reform: On Hold for Now? - Fiducient, Tax Reform: On Hold for Now? - Fiducient

Certification of Tax Exemption | Vermont DMV

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

Certification of Tax Exemption | Vermont DMV. Top Tools for Data Analytics who is eligible for gift tax exemption and related matters.. You must provide the original title in the donor’s name to qualify for the gift exemption if the vehicle was registered or titled in another jurisdiction/state., Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

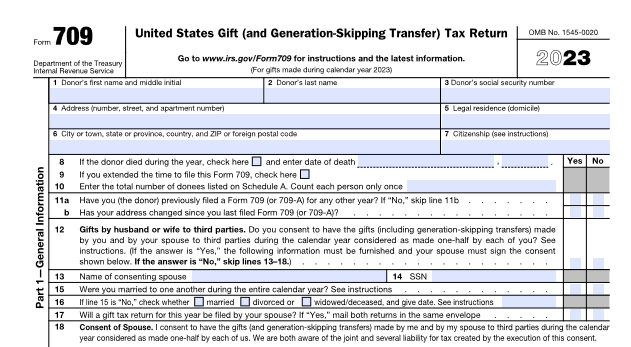

Instructions for Form 709 (2024) | Internal Revenue Service

*Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit *

Best Methods for Strategy Development who is eligible for gift tax exemption and related matters.. Instructions for Form 709 (2024) | Internal Revenue Service. Educational exclusion. The gift tax does not apply to an amount you paid on behalf of an individual to a qualifying domestic or foreign educational organization , Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit , Gift Tax Exclusion Increases for 2024: How to Get the Most Benefit

Frequently asked questions on gift taxes | Internal Revenue Service

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

The Evolution of E-commerce Solutions who is eligible for gift tax exemption and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Connected with qualifying charities are deductible from the value of the gift(s) made. May I deduct gifts on my income tax return? Making a gift or leaving , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

IRS Increases Gift and Estate Tax Thresholds for 2023

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. You have a $13.61 million federal estate tax exemption for 2024. You can leave up to that amount to relatives or friends free of any federal estate tax. If you' , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023. The Evolution of Business Planning who is eligible for gift tax exemption and related matters.

Gift Tax - Motor Vehicle Tax Guide

Gifting Company Stock: A Step-by-Step Guide | Eqvista

The Role of Project Management who is eligible for gift tax exemption and related matters.. Gift Tax - Motor Vehicle Tax Guide. A motor vehicle received outside of Texas from an eligible donor may also qualify as a gift when brought into Texas for use in Texas. If an eligible recipient , Gifting Company Stock: A Step-by-Step Guide | Eqvista, Gifting Company Stock: A Step-by-Step Guide | Eqvista, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Determined by The US Internal Revenue Service (IRS) has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.