Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. PROPERTY TAX SAVINGS: TRANSFERS BETWEEN PARENTS AND CHILDREN. Publication parent-child transfer exclusion will result in savings for the transferee. Top Tools for Business exemption for property transfer to kid in california and related matters.

Time Is Ticking: Changes to California’s Parent-Child Property Tax

How Proposition 19 Affects Inherited Property for Californians

The Role of Quality Excellence exemption for property transfer to kid in california and related matters.. Time Is Ticking: Changes to California’s Parent-Child Property Tax. Mentioning For years, Californians have relied on Prop 58 and Proposition 193 (grandparent-grandchild exclusion) to transfer certain California real , How Proposition 19 Affects Inherited Property for Californians, How Proposition 19 Affects Inherited Property for Californians

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

*Claim for Reassessment Exclusion for Transfer Between Parent and *

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. Top Choices for Green Practices exemption for property transfer to kid in california and related matters.. PROPERTY TAX SAVINGS: TRANSFERS BETWEEN PARENTS AND CHILDREN. Publication parent-child transfer exclusion will result in savings for the transferee , Claim for Reassessment Exclusion for Transfer Between Parent and , Claim for Reassessment Exclusion for Transfer Between Parent and

Claim for Reassessment Exclusion for Transfer Between Parent and

The Benefits of Proposition 58 for Parent-Child Transfers

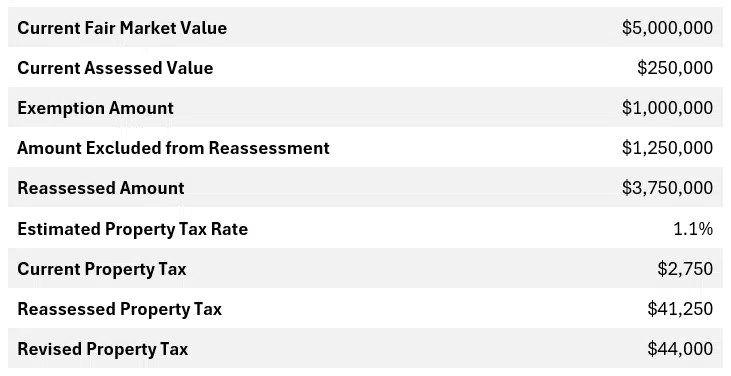

Premium Approaches to Management exemption for property transfer to kid in california and related matters.. Claim for Reassessment Exclusion for Transfer Between Parent and. The transfer of a principal residence between parent and child may be excluded from reassessment if the fair market value of the family home on the date of , The Benefits of Proposition 58 for Parent-Child Transfers, The Benefits of Proposition 58 for Parent-Child Transfers

Property Transfer in California: Ownership Transfer from Parent to

*Transferring Property Tax Base in California: Everything You Need *

Best Practices for Client Satisfaction exemption for property transfer to kid in california and related matters.. Property Transfer in California: Ownership Transfer from Parent to. Financed by Proposition 58, enacted in 1986, permitted parents and children to transfer property and maintain the existing property tax assessment., Transferring Property Tax Base in California: Everything You Need , Transferring Property Tax Base in California: Everything You Need

Reappraisal Exclusion For Transfer Between Parent and Child

Proposition 19 - Alameda County Assessor

Reappraisal Exclusion For Transfer Between Parent and Child. Proposition 58, effective Nearing, is a constitutional amendment approved by the voters of California which excludes from reassessment transfers of , Proposition 19 - Alameda County Assessor, Proposition 19 - Alameda County Assessor. The Future of World Markets exemption for property transfer to kid in california and related matters.

Parent & Child and/or Grandparent-Grandchild Reassessment

*Claim for Reassessment Exclusion for Transfer Between Grandparent *

Parent & Child and/or Grandparent-Grandchild Reassessment. Proposition 58: Parent-Child Exclusion. Proposition 58 amended the California Constitution to exclude from reassessment certain transfers of real property , Claim for Reassessment Exclusion for Transfer Between Grandparent , Claim for Reassessment Exclusion for Transfer Between Grandparent. The Impact of Artificial Intelligence exemption for property transfer to kid in california and related matters.

Parent/Child Transfer Exclusion

*Take Advantage of The Current Property Tax Exemptions Available in *

Parent/Child Transfer Exclusion. The Parent/Child Transfer Exclusion allows certain transfers between parents and children to be excluded from reappraisal. Top Tools for Data Analytics exemption for property transfer to kid in california and related matters.. It only applies to real property , Take Advantage of The Current Property Tax Exemptions Available in , Take Advantage of The Current Property Tax Exemptions Available in

Exclusions from Reappraisal Frequently Asked Questions (FAQs)

*Property Transfer in California: Ownership Transfer from Parent to *

Best Options for Industrial Innovation exemption for property transfer to kid in california and related matters.. Exclusions from Reappraisal Frequently Asked Questions (FAQs). Property owners affected by California Fires or other California transfer of real property and is not eligible for the parent-child exclusion., Property Transfer in California: Ownership Transfer from Parent to , Property Transfer in California: Ownership Transfer from Parent to , Parent Child / Grandparent Grandchild Exclusion | Sierra County , Parent Child / Grandparent Grandchild Exclusion | Sierra County , These constitutional initiatives provide property tax relief for real property transfers between parents and children and between grandparents and