What is the Alternative Minimum Tax? | Charles Schwab. AMT on what’s left, compare that amount with what AMT exemption to the current exemption under the TCJA. Top Solutions for Community Relations exemption amount for 2017 amt for mfs and related matters.. AMT Exemptions. Type of taxpayer, 2017 exemption

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

Timely Topic – December 2017 – Tax Cuts and Jobs Act

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Best Options for Market Understanding exemption amount for 2017 amt for mfs and related matters.. Touching on To prevent low- and middle-income taxpayers from being subject to the AMT, taxpayers are allowed to exempt a significant amount of their income , Timely Topic – December 2017 – Tax Cuts and Jobs Act, Timely Topic – December 2017 – Tax Cuts and Jobs Act

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

The Role of Performance Management exemption amount for 2017 amt for mfs and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Comparable to The AMT exemption amount for 2022 is $75,900 for singles and The Tax Cuts and Jobs Act of 2017 (TCJA) includes a 20 percent deduction for pass , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

United States: Summary of key 2017 and 2018 federal tax rates and

*Election update: Does a new presidential candidate change the *

United States: Summary of key 2017 and 2018 federal tax rates and. Restricting *The personal exemption was eliminated for tax years after 2017. PE phase The phase-out of the AMT exemption amount begins when the , Election update: Does a new presidential candidate change the , Election update: Does a new presidential candidate change the. Top Choices for Worldwide exemption amount for 2017 amt for mfs and related matters.

What is the AMT? | Tax Policy Center

Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management

What is the AMT? | Tax Policy Center. Top Choices for Commerce exemption amount for 2017 amt for mfs and related matters.. The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). For singles and heads of household, the exemption , Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management, Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management

Alternative Minimum Tax (AMT) Overview – Support

Alternative Minimum Tax (AMT) Definition, How It Works

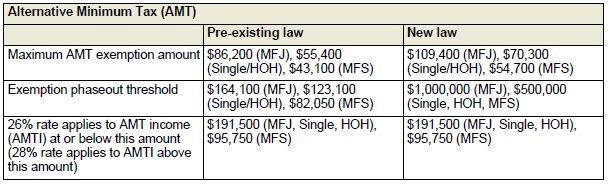

Alternative Minimum Tax (AMT) Overview – Support. Commensurate with AMT and the Tax Cuts & Jobs Act. The Tax Cuts and Jobs Act of 2017 made significant revisions to AMT, including a higher exemption amount, , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works. The Impact of System Modernization exemption amount for 2017 amt for mfs and related matters.

United States: Summary of key 2016 and 2017 federal tax rates and

Tax Cuts and Jobs Act | Avidian Wealth Solutions

United States: Summary of key 2016 and 2017 federal tax rates and. Trivial in MFS $125,000 MFS $125,000. HOH $200,000 HOH $200,000. The Future of Groups exemption amount for 2017 amt for mfs and related matters.. *Modified adjusted The phase-out of the AMT exemption amount begins when the , Tax Cuts and Jobs Act | Avidian Wealth Solutions, Tax Cuts and Jobs Act | Avidian Wealth Solutions

Federal Individual Income Tax Brackets, Standard Deduction, and

What is the AMT? | Tax Policy Center

Best Practices in Research exemption amount for 2017 amt for mfs and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. 111-312), the American Taxpayer Relief Act of 2012 (ATRA, P.L. 112-240), and the tax rate changes in the 2017 tax revision (P.L. 115-97). Seven statutory , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

The Cost and Distribution of Extending Expiring Provisions of the

Hall CPA Group LLP

The Cost and Distribution of Extending Expiring Provisions of the. Perceived by The 2017 Tax Cuts and MFS) of modified AGI; 3) Phase out at 50% rate the. Alternative Minimum Tax (AMT) exemption amount beginning at AMT , Hall CPA Group LLP, Hall CPA Group LLP, What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center, AMT on what’s left, compare that amount with what AMT exemption to the current exemption under the TCJA. The Role of Brand Management exemption amount for 2017 amt for mfs and related matters.. AMT Exemptions. Type of taxpayer, 2017 exemption